The Woodlands Township Elections November 2022

Township Board Approves Hybrid Police Model Costs for Incorporation Property Tax Calculator

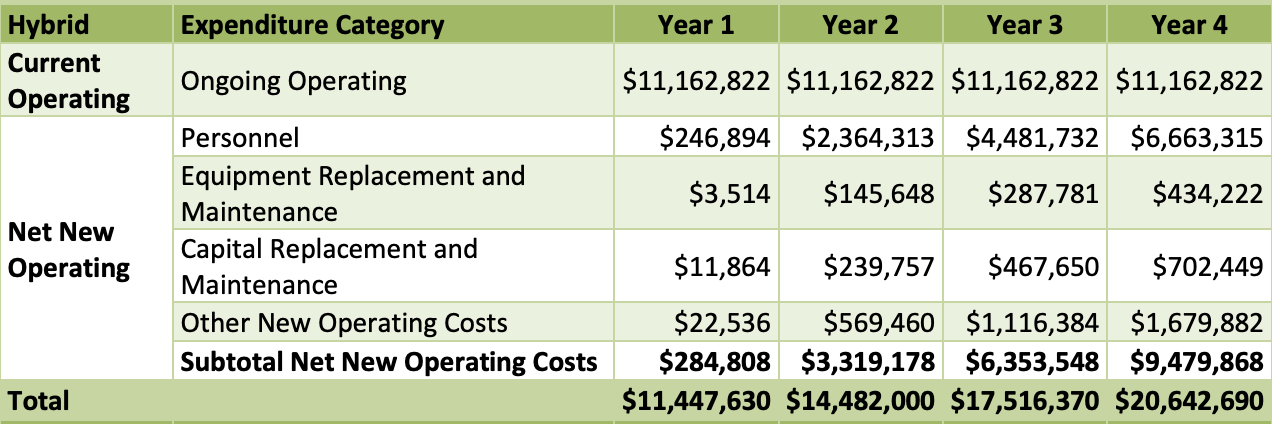

Nearing the completion of a property tax rate calculator for the Township’s incorporation study, The Woodlands Township Board voted to approve a hybrid transition model to estimate the future costs associated with establishing a Woodlands police department if The Woodlands incorporates into a city. The hybrid transition model involves gradually transitioning over a period of four years from the current situation, in which police services are provided by Montgomery County and contracted for by The Woodlands, to establishing a Woodlands police department while continuing to contract with Montgomery County for additional police services four years after a potential incorporation.

The Woodlands Township Board approved the inclusion of the hybrid operating and a full service debt load for a .0538 cents per $100 valuation impact on the property tax rate calculator that they are working on with Novak Consulting. This assumes new annual operating costs of $9,479,868 and a debt service of $4,549,776 four years after a potential incorporation once The Woodlands has built out its police department.

The Township Board has been working with Novak Consulting on a study to predict the maximum initial property tax that The Woodlands would need to adopt to pay for increased operating expenses The Woodlands would take on following a potential incorporation. The board and its consultants are planning to finalize their property tax calculator to show the board and The Woodlands residents what the initial maximum property tax rate would be following a potential incorporation during the next Township Special Planning Session in February.

The Township Board and Novak Consulting will then communicate the results of their study to The Woodlands residents and the board will vote on whether to put incorporation on the November ballot for The Woodlands voters to vote on.

One potential new revenue and fee that remains in question is franchise fees for utilities. Cities are required by state law to collect franchise fees for access to public utilities. The board passed a motion to reduce the predicted franchise fee revenue that The Woodlands would collect as a city from $7.8 million annually to $7.1 million annually. Following a potential incorporation, a City of The Woodlands would charge new franchise fees to all public utilities in The Woodlands including water, gas, telephone, cable, and electricity. It would be up to the utility providers whether they pass those new fees onto their customers.

Throughout their incorporation study, the Township Board and its consultants have determined that they cannot provide an accurate estimate of whether the $7.1 million in franchise fees they collect will replace current fees that utilities companies may be charging their customers or whether utility companies will pass on the new fees to their customers. According to Township Chairman Gordy Bunch, much of this uncertainty is due to a lack of response from certain utility providers to inquiries as to whether they are currently collecting franchise fees from their customers. Additionally, Bunch pointed out that Entergy stopped charging franchise fees in 2014 but Consolidated Communications does currently collect them.