The Woodlands Township Elections November 2022

Township Board Refuses to Rebate Incorporation Reserve, Opts to Increase Reserves and Spending

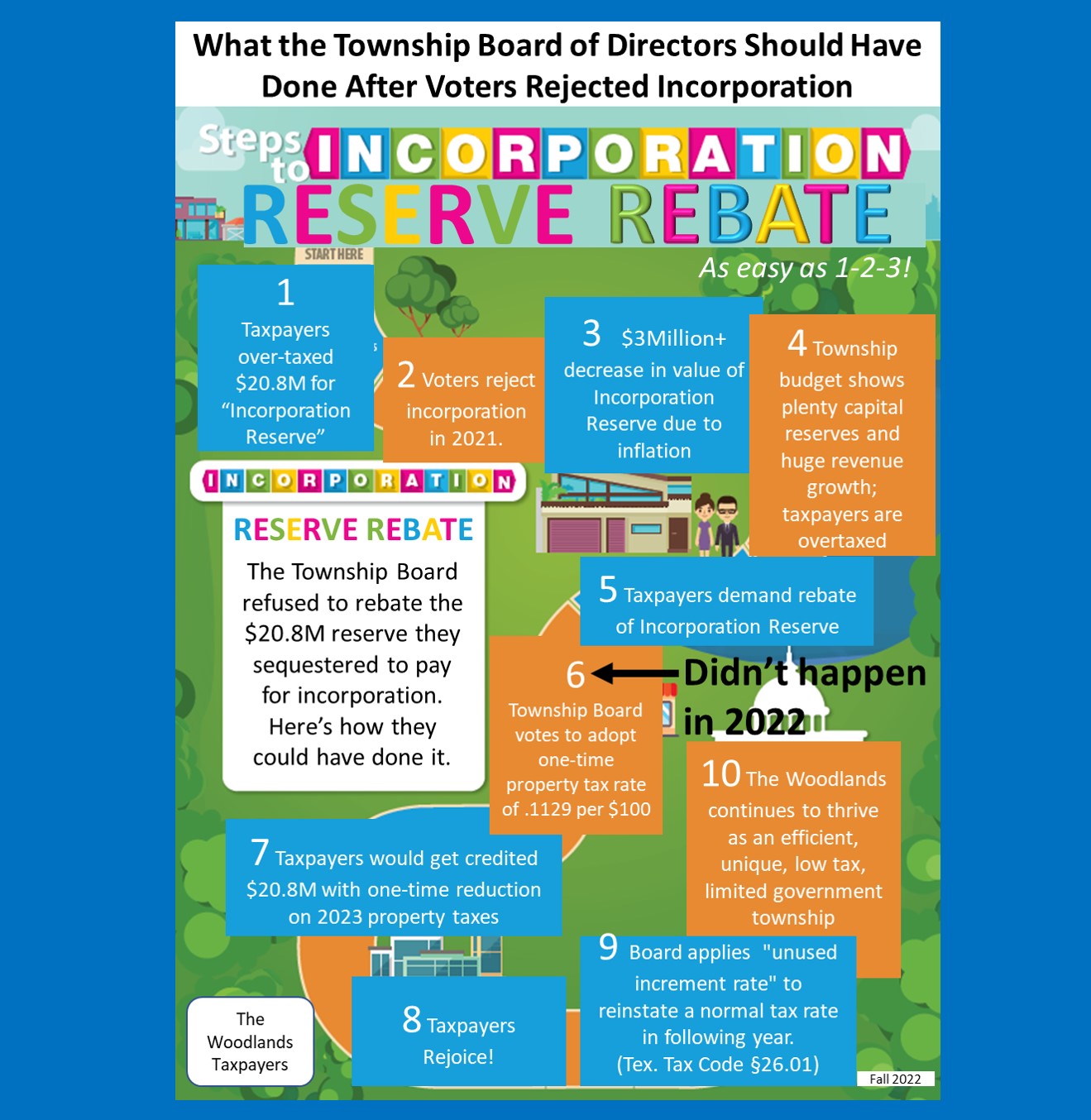

The Township Board rejected calls to return its $20.8M of incorporation reserves in full to The Woodlands taxpayers through a one-time property tax rebate of $.0835 and 2023 property tax rate of $.1129* per $100 of valuation. With a new $19.8M** in estimated annually recurring revenue surplus and $20.8M of newly available incorporation reserves, the Board chose to give back only $2.8M of that $40.6M to property taxpayers through a property tax rate decrease.

Instead of a full $.0835 rebate to refund the incorporation reserves after voters rejected incorporation, the Board chose to offer a much smaller property tax rate decrease, lowering the rate to $.1850, only $.0114 below the no new revenue rate of $.1964.

The Board ultimately decided to reallocate the incorporation reserves to fund future fire station and park upgrades, including "the best lazy river in Texas." Great, because incorporation was voted down by the community, The Woodlands can now afford capital expenditures to upgrade our top-of-the-line fire department and parks. While these upgrades may be nice, their funding appears to be an accidental by-product of a disastrous incorporation boondoggle pushed by an “incorporation squad” of Directors.

Although there is no longer technically an "incorporation reserve," the Township's total capital reserves have grown from $108.6M to $111.2M, and this tax dollar funded piggybank continues to shrink in value by over 8% YoY due to inflation.

Incorporation squad leader and Board Chairman Gordy Bunch claimed that the Board could not "legally" lower the Township property tax rate by $.0835 for one year because it would "dangerously" require voter approval to raise the rate the following year.

Bunch said "It would be impossible because of the new 3.5% law that would not allow you to reduce your rate in order to provide some tax relief based on reserves because the very next year you would have to go for voter approval to reapprove the rate you need just to fund basic services." No one on the Board disagreed with him, and all other Directors were notably silent on this matter.

However, the Texas Comptroller's statements on the new Texas property tax laws and Texas Tax Code §26.01 regarding "unused increment rates" clearly show that this was misinformation.

According to the Comptroller, "The unused increment rate is the three-year rolling sum of the difference between the adopted tax rate and the voter-approval tax rate...The unused increment rate can be used to increase the voter-approval tax rate, depending upon the tax rates adopted by the taxing unit in the previous three years. For example, a city has the ability to 'bank' any unused amounts below the voter-approval tax rate to use for up to three years." Certainly, the Board should have researched the new property tax laws?

Chairman Bunch also said that credit agencies could downgrade The Woodlands' AA+ credit rating if the Board rebated this money to taxpayers. This is most likely false, because that new $19.8M of annually recurring revenue surplus is more than enough to make up for a one-time rebate of $20.8M.

On that point, it's also worth questioning what would have happened to our credit rating and property tax rate had The Woodlands chosen to incorporate, spent its incorporation reserves, and taken on large new ongoing costs associated with incorporation. And in that case, where were the funds to come from for those fire station and parks and recreation upgrades? Or for building that “best lazy river?"

In the budget meetings, Chairman Bunch also made the comment that a portion of the excess revenues that the Township used to fund its reserves came from positive sales tax variances. “We’d have a hard time tracking down those visitors who came here and spent money at our mall to return those positive variances,” he said in response to a public comment by local taxpayer Steve Leakey that the township should return some of its discretionary reserves to taxpayers. Very funny… but not so funny for taxpayers in The Woodlands.

Why shouldn't the board strive to utilize sales taxes to reduce taxes on property owners who have long invested themselves and their resources into our community? Our Township with its unique Towncenter and special purpose districts were designed to generate robust sales and hotel tax revenues to fund government services in lieu of property taxes on homeowners and businesses.

Instead of returning the fund that was supposed to pay for incorporation and was built by overtaxing taxpayers in The Woodlands for years, the Board ultimately elected to increase the Township's capital reserves and spending.

The incorporation squad and their followers dragged our community through their single-minded, obsessive, and unwanted pipedream for the last several years. Fortunately, with the upcoming Woodlands Township Board of Directors elections, our community can vote to “reset” the Board. Squad leaders Chairman Gordy Bunch and Vice Chairman Bruce Rieser are not running for reelection, and that’s a good start. In fact, there is a fresh slate of candidates who actively pushed back against the incorporation boondoggle and are running for Director positions 1, 2, 3, and 4: Brad Bailey, Linda Nelson, Richard Franks, and Kyle Watson. Those are the candidates who I’m backing and who I believe will truly serve The Woodlands community.

Yours truly,

Bruce Tough

Former Chairman, The Woodlands Township Board

*rebate of $.0835 subtracted from the no new revenue rate of $.1964 for a 2023 property tax rate of $.1129 and one-year tax reduction of $20.8M

**The Woodlands is predicted to generate $10.8M of new revenue in 2023 that was not accounted for in the 2022 budget, mostly due to increases in sales and hotel tax revenues. Furthermore, the decision by Montgomery County to begin funding more of The Woodlands' law enforcement costs will also provide the Township with at least an additional $9M decrease in annual expenses beginning this budget cycle.