The Woodlands Township Elections November 2022

The Woodlands Township Board Lowers Property Tax Rate After Spirited Debate

At a September 18 tax rate adoption meeting, The Woodlands Township Board of Directors was divided on whether to raise or lower The Woodlands’ property tax rate. Facing a deadline, on the fifth vote of the night, the board ultimately voted unanimously to adopt the effective tax rate of .224% after directors Ann Snyder, John McMullan, and Carol Stromatt held the line and refused to vote in favor of increasing property taxes.

Director Snyder pointed out that the budget was balanced for 2020 at the effective rate(the lowest rate being voted on), and that most of the other local taxing entities adopted effective tax rates for 2020 following the recent property tax reform and school funding bills passed by the state legislature.

“The people have asked for a reduction in taxes, and our own state legislators with SB2 and HB3 have forced tax reform, and our state legislators were leaders of both of these bills. Montgomery County adopted the effective tax rate, Montgomery County Hospital District, Conroe ISD, Montgomery ISD, and Tomball all lowered their rates,” Snyder said.

According to state law, to pass a property tax increase, board members have to vote in favor of the new rate as a super majority, meaning at least 60% or 5 out of 7 votes in favor. Additionally, if the Township fails to adopt a new rate before September 30th, it would automatically adopt the effective tax rate.

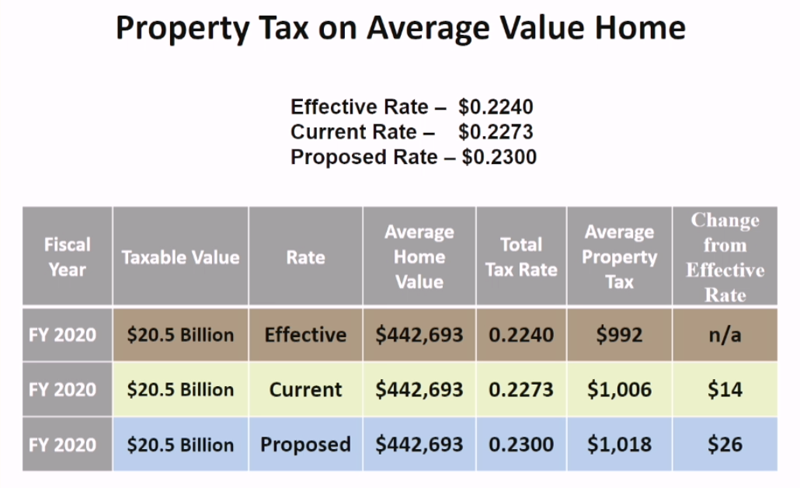

In a first round of votes, the board failed to pass three different property tax rates: a proposed higher property tax rate of .23%(Failed 4-3), the current tax rate of .2273%(Failed 4-3), and the effective tax rate, which would gather the same total amount of property tax revenue as last year at .2240% (Failed 3-4). Township Chairman Gordy Bunch, and Directors Bruce Rieser, John A. Brown and Brian Boniface voted in favor of the two higher rates, and Directors Ann Snyder, John McMullan, and Carol Stromatt voted for the lowest rate.

Directors in favor of increasing property taxes said it was the financially responsible thing to do in order to fund the Township’s capital reserves to be able to offset potential unplanned expenses and losses of revenue in the future. They foreshadowed that if the Township didn’t raise the property tax to the proposed rate this year, that it could be raised more drastically in the coming years.

One potential loss of revenue cited was that the Township would lose a significant amount of tax revenues if Occidental Petroleum, which recently acquired Anadarko, decides to relocate its employees outside of The Woodlands and sell its Woodlands assets.

“Either one of these rates, the current or the proposed, put this community in a stronger financial position to better address its unforeseen needs and circumstances 11 months from now than dropping it down all the way to the effective rate. I think anything short of the current rate or the proposed rate puts the community at risk…We’re not going to resolve all those unknown conditions, so we’d be hoping to cover the projected shortfalls. To me that’s a mistake, I think we should plan on covering what is staring us in the face and go out there confidently saying this is a sustainable rate for now… It’s easy to lower taxes; it’s easy to say we adopted the effective tax rate. It’s hard to do the right thing, but I’m more willing to do the right thing than the easy thing,” said Chairman Bunch, before motioning to adopt the .23 rate, which he pointed out was a 2.68% increase.

Director Rieser also spoke adamantly against the effective tax rate saying, “You guys are introducing a risk that is absolutely avoidable. If we want go down this road, it’s fine, but we’re kicking the can down the road. I am really disappointed that we can’t come together as a board, knowing exactly what is going on. No one on this board is denying the risks we are looking at, and yet we’re sitting here arguing about $14 a year for the average taxpayer."

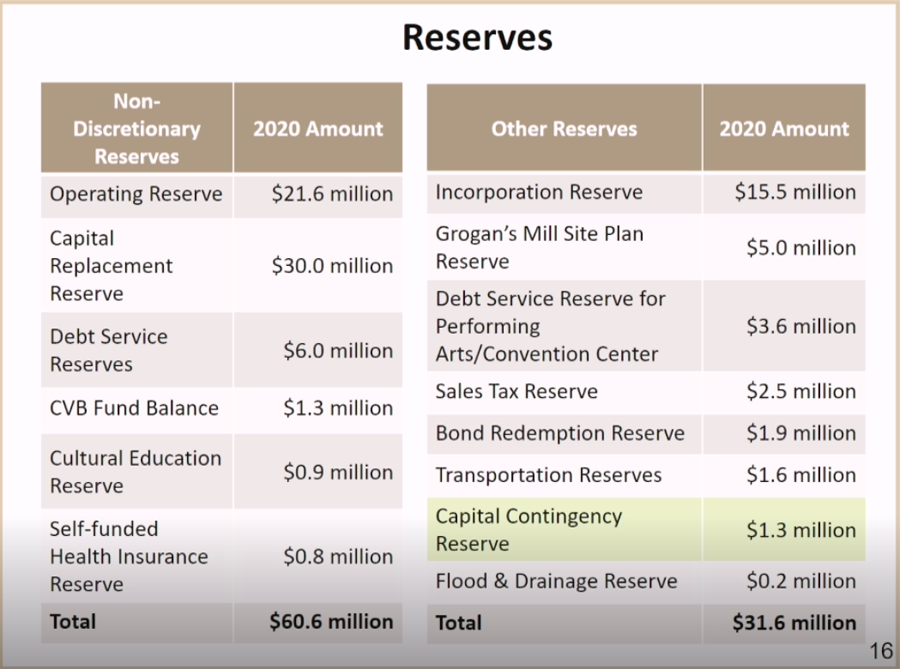

Director Stromatt suggested the idea of utilizing some of the Township’s various reserves to fund any possible budget shortfalls that could occur, instead of increasing property taxes.

“There’s nothing that says we can’t come back to a meeting down the road if we see that something isn’t working and make a change…I don’t believe that we need to raise the tax rate in order to do that; I believe we have funds we can allocate to that,” said Stromatt.

This idea was also suggested by Claude Hunter, a Woodlands resident who gave public comment at the meeting. Hunter suggested the Township spend some of the $15.5 million that it has already collected and set aside in its incorporation reserve, which is meant to offset the future costs of a potential incorporation of The Woodlands into a city that may never occur.

“There is plenty money available to handle things that are priorities, and I refer specifically to $16 million that has been put aside for incorporation without any indication from voters that they want to spend $16 million for it. That decision must come later and may never be necessary. But the bottom line is that $16 million should be used somewhere where it’s necessary,” said Hunter.

Director Brown, who favored raising the tax rate to the proposed rate, said spending the Township’s reserves was short sighted.

“Once those reserves are gone, they’re gone. So that doesn’t affect our ongoing operation and expenses and revenues…Spending our savings is not the answer for a long term solution,” said Brown.

Director Rieser agreed with Brown and said that spending reserves would have a negative effect on the Township’s bond rating. “It’s a good thing that we’re redoing our debt now because this will have a negative impact on our bond rating. If we start planning to use reserves to fund normal M&O expenses on a yearly basis, we’re going to tank our bond rating, and that’s a fact,” he said.

After discussion following the first round of votes that failed to adopt a new rate, Chairman Bunch called for a compromise at the middle and current rate of .2273.

“We’ve all stated our case, we’re all for the outer band: the proposed or the effective. But I think the adults should compromise and take the current rate,” said Bunch, before motioning for a second vote to adopt the current tax rate of .2273, which failed 4-3 when Snyder, McMullan and Stromatt voted against it again.

Follwing the failure of the fourth vote, Rieser reluctantly agreed to vote for the effective tax rate, and Bunch, Boniface and Brown followed.

After a night of debate, a fifth vote found success when all seven board members agreed to adopt the effective tax rate of .2240. Ultimately the Township Board of Directors voted unanimously to not increase The Woodlands’ property taxes this year.

“.2240 gives us a balanced budget for 2020 and it’s not reducing amenities or services for our community. I’ve always represented our residents and have no personal agenda. People asked for a reduction in taxes, and I felt it was the right thing to do,” said Snyder in an interview with The Woodlands in Focus after the meeting.