The Woodlands Township Elections November 2022

Incorporation - Don’t Mess with The Woodlands!

WHY has the Township Board decided to conduct another expensive Incorporation Study? An unanswered question! Several residents have asked me, “What problem is the board trying to solve?” An unanswered question! We have a relatively safe community with a low crime rate. The consultants tell us we have the best roads of any city of our comparable size. Our widespread use of covenants ensure that we have stronger regulations over development and existing properties than any city can achieve using ordinances. We have a relatively low Township property tax rate. So again, what problem does the board believe we need to so urgently solve?

Introduction

Like everyone else, I am trying to understand the information being developed by the consultants. The purpose of this article is to try to summarize what I have learned and to articulate the implications of the studies underway.

In April 2018, The Township Board commissioned a $872,000 Incorporation Study, hiring two consulting firms, Matrix and Novak. This study is expected to be completed sometime in the Spring of 2019. At that time, The Township Board will decide if it will call an election for the Woodlands voters to decide if they wish to incorporate prior to November 2057.

Why Conduct a Second Expensive Study Now?

When Board Members have been asked why they decided to support conducting another expensive study, their response was that they believe incorporation offers the following advantages:

- Obtain the ability to enact laws and ordinances

- Provide greater control of all municipal-type services and functions with more consolidated service delivery

- Stop clear cutting of our trees

- Prevent unbuilt roads from bringing more traffic into our community, such as the Woodlands Parkway Extension

- Slow down development

- Eligibility for The Woodlands to apply for FEMA funding (instead of receiving it through the county)

For those who appear to support incorporating sooner rather than later, these expectations may far exceed the actual benefits to be derived from becoming a city. The subject of incorporation is a complex subject, made more complex by what the state statues allow and do not allow a General Law City to do.

But these responses ignore the viewpoint of our residents as expressed by the 1,553 respondents to the 2016/17 Resident Survey:

- 85% believed the Township, MUDs and Counties provide a high level of quality services and are receiving value for the taxes they pay. If we have a “fractured service model,” the residents do not appear to think it adversely affects the quality of the services they are receiving today.

- 38% did not see the need for any additional services. They appear to be happy with what is being provided today.

- 70 % of the respondents saw no reason to incorporate within the next five years.

In 2014, the first year The Woodlands could call an incorporation election, the Board elected not to do so. The clear feedback from the residents told us there was no reason to do so in the foreseeable future. Our residents were uniformly concerned with the higher cost of becoming a city, increased government and bureaucracy, increased regulation and a reduction in the value they would receive from their county property taxes.

What is Wrong with our Current Governance Model?

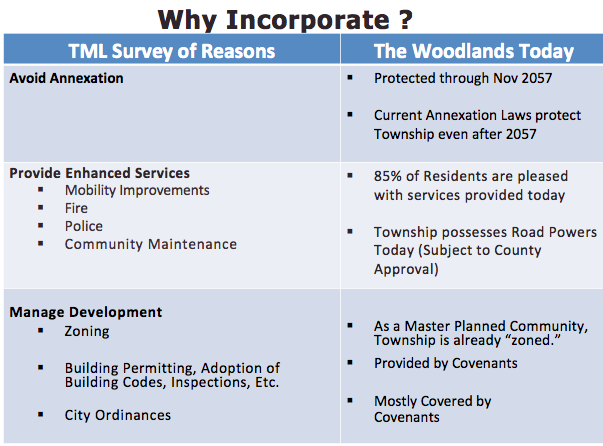

As stated earlier, a clear majority of our residents believe the current mixture of Township, MUDs and County services provide a high level of quality services and are receiving value for the taxes they pay. If we have a “fractured service model,” the residents do not appear to think it adversely affects the quality of the services they are receiving today. I point to a recent survey by the Texas Municipal League of why unincorporated areas chose to become a city and why, as a Master Planned Community, we are different:

From the above, one can clearly see we are unique case! None of the normal reasons communities decide to become a city apply to us or offer a strong rationale for incorporating anytime within the foreseeable future. For example, most communities wish to become their own city to avoid annexation by a neighboring city. But we have no such risk.

Most of the Township Board Members have repeatedly professed they have an open mind on the question of incorporation and are still analyzing the facts. However, at a recent Township Board candidate forum held by The Woodlands Area Chamber of Commerce, Director Boniface clearly came out in favor of incorporation sooner rather than later. In an article in the Chronicle on October 14, Director Rieser stated that if The Woodlands does not incorporate, it runs the risk of being “chopped up” and absorbed by the City of Conroe and Houston. At the September 25 Public Forum, these same scare tactics were used. The board members know better than most that our Regional Participation Agreements fully protect us from being annexed until November 2057. There MAY be a reason to incorporate at some point down the road but avoiding annexation is not one of them!

Why Can’t The Woodlands be Annexed?

There are many factors Woodlands Voters will need to evaluate in deciding if they wish to become a city. But for the following reasons, the fear of annexation should not be one of them:

- In 2007, The Woodlands voters overwhelming approved a Regional Participation Agreement (RPA) with the Cities of Houston and Conroe to determine our own governance structure and avoid annexation by either city until after November 16, 2057. This agreement cannot be terminated or changed by the legislature and will remain in effect as long as The Township continues to pay the two cities the monies due each year, 1/16th of a portion of our sales tax (1%). This agreement runs for 99 years and will continue even after we incorporate. Becoming a city will have no effect on the agreement.

- During the 85th legislature, the regulations pertaining to “forced” annexation of property within a municipality’s territorial jurisdiction were substantially changed in the favor of protecting individual property rights. Governor Abbott signed this new legislation into law in August 2016. The legislation was codified in the Local Government Code Chapter 43 and came into effect on December 1, 2016. These new regulations require that a Home Rule City, such as Conroe and Houston, may not forcibly annex us against our will. With this new legislation in effect, neither the City of Houston or Conroe may annex The Woodlands without the permission of a majority of The Woodlands voters. Why would we ever approve or request to be annexed?

- The Cities of Oak Ridge North and Shenandoah cannot annex us as they have no such authority unless we requested them to do so. And, even then these cities would have to secure permission from Conroe and Houston to do so.

September 25 Public Forum

I was encouraged by the Public Forum on September 25 where approximately 300 residents turned out. Many good questions were asked. During the meeting, Matrix and Novak consultants provided a recap of incorporation studies to date such as the best practices analysis, law enforcement analysis, pavement analysis study, and a review of MUD operations. They also provided a revised law enforcement option which was a combination of a city police force and the continued use of the Montgomery County Sherriff’s (MCSO) services. A link to the presentation provided can be found by clicking here. In addition, a website dedicated to the incorporation study can be found at https://www.thewoodlandsincorporationstudy.com/ with links to all documents, and videos of all meetings.

Early Incorporation Cost Estimates

Although the Incorporation Study is only half finished, the preliminary facts are already clear- incorporation will bring increased bureaucracy and more responsibilities for The Woodlands government, which in turn will cost more and increase our property taxes with no real clear benefit. As the Villager recently reported a frequently asked question during this meeting was “why is this process even happening.”

Although the precise impact incorporation will have on our Township property taxes is not known yet, common sense tells us they will increase. Additionally there will not be a corresponding reduction in our County Tax Rate.

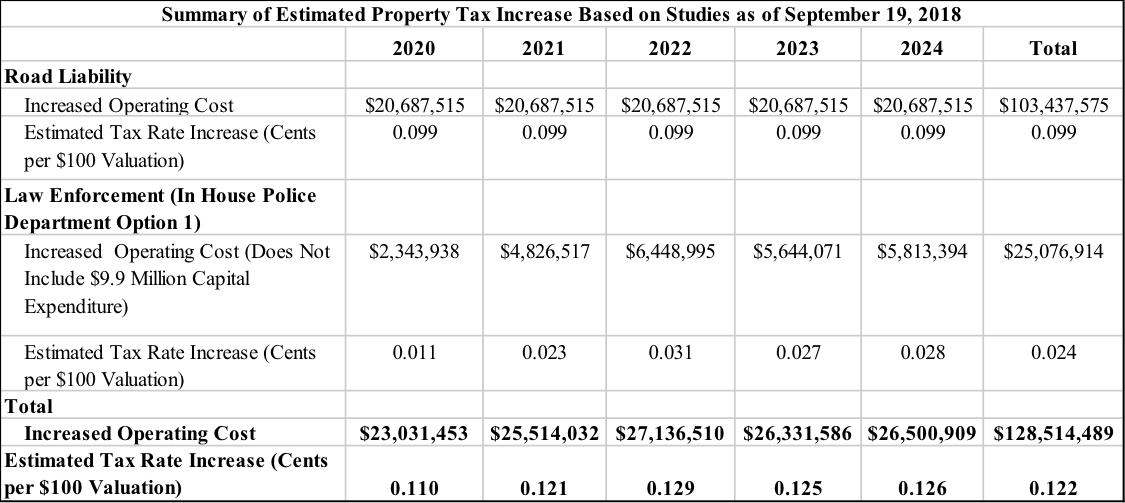

For example, the current studies point to the following cost increases over the first five years after becoming a new city:

- Regardless of the options chosen, it is estimated that over the first five years we will face a $25 Million increase in the operating cost for Law Enforcement. There is no large reduction in these costs even if we stay with our current contract approach with MCSO. It will still cost us an average of $4.2 Million per year more than today. As a city, MCSO may not be able to completely fund the 25 deputies they provide today. In addition, if The Woodlands continues the existing MCSO contract approach, the new city will not benefit from any revenue derived from fines, as all such revenue will accrue to the County. These costs will add over $0.02 cents annually to our property tax rate with no additional boots on the ground.

- Creating our own in-house police department will require $9.9 million in capital cost, including the construction of a new 34,000 sq. ft. police department building. The consultants have recommended The Woodlands transition to our own police department over a three-year period, starting with the elimination of the use of the Harris County Constable Office in Creekside Park. Some presence of an in-house police department will be needed to enforce city ordinances.

- We will have to assume a liability of $103 million over the next five years to maintain and develop our roads. Through 2057, this liability will grow to $389 Million. This includes over $100 million in road expansion costs that HR Green acknowledged have not been included in their Pavement Analysis Study. In addition, the current study has underestimated the cost of reconstructing our aging roads by assuming that their useful life will be 100 years. The more realistic estimate by other engineers is closer to 50 years. These costs will add almost $0.10 cents annually to our property tax rate.

As shown below, in total, over the first five years of being a new city, the above increased costs alone will add an average of least 12.2 cents to our current property tax rate, a 54% increase. As the study progresses, how much more additional costs could we be facing?

At the September 25 public forum, Chairman Bunch asserted that these increased costs could be negotiated away by the county agreeing to bear them in lieu of the new city. What would the other cities in Montgomery County think about the county agreeing to such a great deal with The Woodlands at their expense? Given the uncertainty of any negotiations with Montgomery County, it is important that the cost of incorporation be viewed over at least a five year period and that both a best and worst case scenario be presented to The Woodlands residents.

Annexation of Our MUDs

If The Woodland’s voters decide to incorporate, a subsequent question will be whether a future city council will annex all the MUDs including Creekside Park MUD 386 to form a new city water department. Annexation of our MUDs is not a requirement of becoming a city. The MUD annexation question cannot be voted on as part of any incorporation election. This is a decision that as a general law city we will be able to vote on.

We will have to trust future city councils and elected politicians to make the right decision after we incorporate. Do we want to take that risk? Annexation of our MUDs will require the new city to absorb approximately $323.3 million in debt. There will be an option for the new city to either increase our water rates or city property taxes to cover the water and sewer costs absorbed by such an annexation. However, due to existing MUD debt covenants, the city may not be able to eliminate the use of property taxes to cover the required debt service.

The September 20 Incorporation Planning Meeting was largely devoted to a discussion relating to the MUDs and their possible annexation if we ever incorporate.

The Board agreed with the following recommendation made by HR Green.

“The existing governing structure established over time through MUD creation and intergovernmental agreement is well understood locally. It provides lines of communications and transparency for the operation of a substantially large utility system that is currently, reasonably managed. The existing system has some identified risks and constraints as referenced in this report, but involvement by The Woodlands through an incorporation process and service agreements will address some of these. It is recommended, therefore, that the current operation model remain in place.

Potentially, WJPA staff and capital assets could be consolidated with existing Township assets. This would represent, however, relatively minor changes in overall projected expenditures. Finally, since debt liabilities and tax allocation policies vary between each MUD based on their respective ages and infrastructure condition, overall dissolution of the MUDs would likely prove difficult.

However, implementing a policy that targets MUD acquisition based on existing debt load may be considered. Current MUD service agreements can stay in place and be modified to account for changes in MUD participation over time. As an alternative, these agreements could be re-negotiated from the start so that The Woodlands would take over all of the operation and maintenance responsibility while the MUDs are acquired over time.”

What the consultants and the current Township Board recommend is a moot point as the decision whether to annex the MUDs will be decided by a future City Council. A decision that as a General Law City we will not be able to vote on.

As shown in the chart below, there are currently 11 MUDs within the boundary of The Woodlands. One of these MUDs, Creekside Park MUD 386, is within Harris County. MUD (386) is a more traditional MUD. All our MUDs have transitioned away from the developer and today are resident controlled. The Woodlands MUDs within Montgomery County operate very differently. George Mitchell was astute in designing an effective and efficient relationship between our MUDs, the San Jacinto River Authority (SJRA) and The Woodlands Joint Powers Association (WJPA).

If the MUDs are eventually annexed after we incorporate, will you end up paying more or less? It will depend-some property owners will become winners, and some will become losers. Just compare the property tax rate for your MUD to the current composite MUD property tax rate of $0.2089 shown above.

-------------------------------------------------------------------------------------------------------------------

In closing, it appears a lot of effort and money is being spent on an issue of seemly little concern to most of our residents. I am sure those who have been flooded over the last few years could suggest better uses for the money being spent on or allocated to the subject of incorporation-Stop the Flooding!